reverse sales tax calculator texas

Selling Price Final Price 1 Sales Tax Reverse Sales Tax Definition Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Additional Business Financial Calculators Available Economic Calculator Reference Page.

Texas Sales Tax Calculator Reverse Sales Dremployee

Formula s to Calculate Reverse Sales Tax PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes Not all products are taxed at the same rate or even taxed at all in a given municipality.

. How 2022 Sales taxes are calculated in Arlington. This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. Subtract the discount rate from 100 to acquire the original prices percentage.

Input the Tax Rate. This app is especially useful to all manner of professionals who remit taxes to government agencies. Input the Tax Rate.

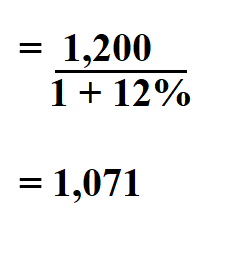

Input the Final Price Including Tax price plus tax added on. The reverse sales tax formula is written as original price final price 1 sales tax rate according to Accounting Coach. Texas has a 625 statewide sales tax rate but also has 815 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1345.

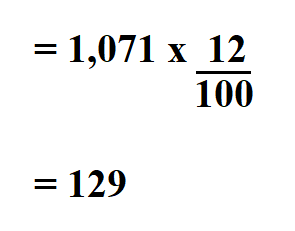

This is especially beneficial if you have to list your out-of-state purchases to you current state of residence and the taxes paid on those purchases. Calculate this by dividing the final purchase price by 1 plus the sales tax rate which equals the items cost before the sales tax. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable servicesLocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Reverse Sales Tax Formula. Reverse Sales Tax Formula.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. Calculates the canada reverse sales taxes HST GST and PST. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price.

The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. This script calculates the Before Tax Price and the Tax Value being charged. You can also use this to work out what your new take home pay would be if you got a pay rise or changed jobs.

You obviously may change the default values if you desire. Reverse Sales Tax Calculator Remove Tax. Tax Me Pro also comes equipped with a fully functional calculator the ability to save lists of items reverse tax calculation and a companion Apple Watch app.

Now you can find out with our Reverse Sales Tax Calculator Our Reverse Sales Tax Calculator accepts two inputs. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

Reverse Sales Tax Calculator. Tax calculator A Money Detective tool designed to allow you to work out how much tax you are paying and what your net after tax salary should be. Description Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

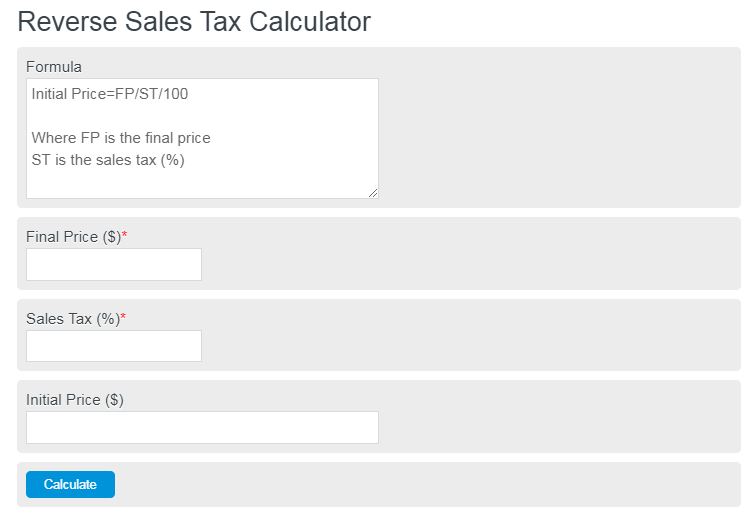

How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. Here are the steps. Here is the Sales Tax amount calculation formula.

We can not guarantee its accuracy. A Reverse Sales Tax Calculator is very useful for tax purpose because if you itemize your deductions and claim credit for the overpaid local and out-of-state sales taxes on your taxes. It is a unique sales tax calculator that is easy to use accurate and attractive.

The Arlington Texas general sales tax rate is 63. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. Depending on the zipcode the sales tax rate of Arlington may vary from 63.

Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and price before tax. This script calculates the Before Tax Price and the Tax Value being charged. The first script calculates the sales tax of an item or group of items then displays the tax in raw and rounded forms and the total sales price including tax.

Tax Me Pro is designed with quality and functionality in mind. First determine the cost of the item without sales tax. Sales Tax total value of sale x Sales Tax rate If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax.

In Texas prescription medicine and food seeds are exempt from taxation. Collecting Sales Tax Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018. You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. We can not guarantee its accuracy. Reverse Sales Tax Calculator Remove Tax.

52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. Enter the sales tax percentage. Reverse Sales Tax Calculator.

Input the Final Price Including Tax price plus tax added on. You can use this method to find the original price of an item after a discount or a decrease in percentage.

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Sales Tax Backwards From Total